The best way to learn options trading is by combining learning and doing. Learn the principles and theory, and then practice as much as possible.

Here’s the process in more detail:

1. Learn Options Principles & Theory

Options trading is a complicated beast, and it pays to know as much as possible about the basics before trading for yourself.

That may seem a little daunting, but there is some work to be done before you can confidently, and competently, trade options for real.

Thankfully we can help on this.

We’ve created all the info you need to trade option and suggest you go through the following post to get yourself up to speed on the basics:

Start with our post on How Options Work: Trading Put & Call Options which will give you the basics on the two option building blocks: puts and calls.

Then we suggest you learn how you might combine trades in two or more options to create an options spread: Options Spreads: Put & Call Combination Strategies.

And then perhaps become familiar with some of the more basic options spreads such as a Covered Call, Calendar Spread or Iron Condor.

Finally you might familiarise yourself with some of the key options terms such as Implied Volatility and the Greeks.

There are also some excellent videos on youtube to watch. here are some we recommend:

The Best Ways To Learn Options Trading Videos:

2. Options Paper Trading

The next step is to do some options trading yourself, but without risking any cash.

You can do this this ‘paper trading’ as its called on several of the popular options brokers’ sites.

These brokers allow you to load up a dummy account with fake ‘money’ and trade the market – all at no risk. You’ll get all the functionality of their platform, without risking any hard cash.

This is a great way to practice trades and finesse your strategies before risking any capital.

It’s also a good way to try out the various brokers to see which you prefer.

Here are our choices:

Interactive Brokers:

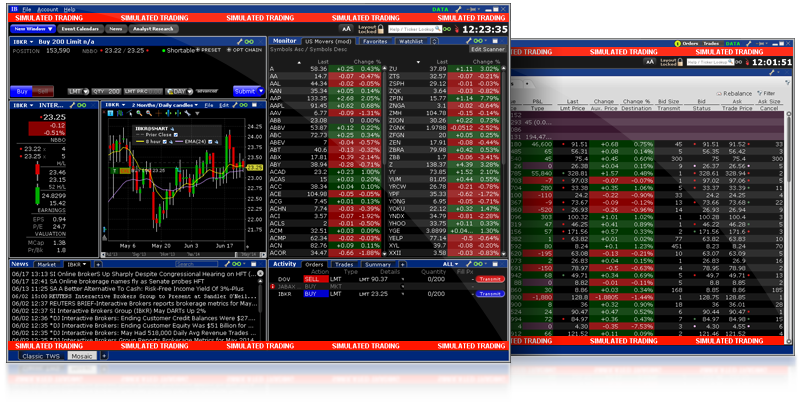

Interactive Brokers offers a full paper trading service for new customers. You’ll have to sign up for an account first (at no cost) and then go to Manage Account >Settings >Paper Trading .

(See here for more info.)

The best thing is you’ll get full access to IB’s great tools:

TD Ameritrade

TD Ameritrade has a great trading simulation environment called paperMoney.

See here for more info.

3. Trade (Slowly) For Real

Once you’ve found a style which, on paper, works and a platform you prefer it’s time to trade using real money.

Start slowly with money you can afford to lose. Indeed once you’ve loaded it into the platform treat it as gone to remove as much emotion from your trading as possible.

You’ll find that even with the above measures, trading with real money is very different to using paper money to practice.

In particular you’ll learn how to enter a trade properly – ie how to price a trade using the buy sell options prices – which is difficult to simulate with paper money.

Once you’ve been through these learning stages you can gradually increase the amount of dollars you have at risk.